We are often tempted to discard our paperwork when organizing, but the challenge lies in knowing what can be safely destroyed and what needs to be preserved. With so many documents, especially from the French administration, it’s difficult to determine how long to keep them. These papers accompany us from birth to death, and it’s not always clear how long they should be retained. Whether it’s a family record book, insurance papers, or official documents, it’s essential to know how long each type of document should be kept. Here’s a guide to help you determine the retention period for bank, tax, insurance, and mutual documents.

WHAT DOCUMENTS SHOULD YOU KEEP FOR LIFE?

Documents that grant rights or benefits should be kept for life as they can resolve disputes when needed. These include:

- Family record book

- Marriage contract or PACS

- Military booklet

- Divorce/separation judgment

- Deeds of donation

A subtle point to remember: When parents pass away, it is essential to retain the family record book that was in their possession.

WHAT TO DO WITH PROPERTY PAPERS?

Whether you are a property owner or tenant, it’s crucial to keep your documents. Why? Because having them on hand is the best way to avoid disputes. This also applies to any work you do on your property. Keep all documents that establish your property rights, such as notarial deeds or partition deeds.

- If you sell your property or move: Keep the documents for 5 years after the sale. Why? Because the sale can be contested within this period.

- If you build or undertake major work: Retain all papers for 10 years. This includes construction or work contracts, invoices, and payment certificates. Your building insurance contract should also be kept for 10 years, as this is the period in which you can make a claim for hidden defects.

- Note: These rules also apply if you are involved with a legal entity like an SCI (Société Civile Immobilière) or commercial entity.

WHAT TO DO WITH HEALTH PAPERS?

For health-related documents, the rules are as follows:

- Keep these documents for life:

- Health record

- Vaccination certificate

- Blood group card

- For medical documents:

- Keep prescriptions for 1 year

- Keep glasses-related documents for 5 years

- Retain other hospital records for the duration of treatment. If the medical documents relate to a serious illness, it’s recommended to keep them longer in case of recurrence.

- Social Security and Family Allowance Statements:

- Retain these for 2 years, which is the legal period for filing a claim if you haven’t received benefits or if you were overpaid.

- In the case of fraud, this period extends to 5 years.

- Keep daily allowances related to accidents or illnesses until you retire.

WHAT TO DO WITH RETIREMENT PAPERS?

Documents related to your retirement should be kept indefinitely. This includes:

- Pensions (civil, military, or survivor’s pensions)

- Retirement payment notices

For papers received during your professional activity, they should be kept until your retirement is finalized. These include:

- Individual situation reports

- Indicative simulations

WHAT TO DO WITH INSURANCE PAPERS?

Insurance papers must not be discarded, even once the contract ends. There are specific regulations on how long these documents should be kept. Here are the suggested retention periods:

- Home, auto, accident, and personal injury insurance: Keep documents for 10 years after the contract ends. If you’ve been a victim of bodily injury, retain documents for at least 10 years after compensation. Keep them for life in case issues arise later.

- Premium receipts: Keep for 2 years.

- Life insurance contracts: Keep for 10 years, starting when the beneficiary becomes aware of the contract.

WHAT TO DO WITH VEHICLE PAPERS?

The retention period for vehicle documents is straightforward. Keep the following for the entire duration of vehicle ownership:

- Purchase invoices

- Repair invoices

These documents may be useful for resale or maintenance tracking.

WHAT TO DO WITH BANK PAPERS?

For bank documents, the following guidelines apply:

- Account statements and checkbook stubs: Keep for 5 years (your bank must retain them for 10 years).

- Real estate or consumer loan contracts: Retain for 2 years after the last loan payment.

- Credit card receipts: Discard once the transactions appear on your bank statements.

WHAT TO DO WITH TAX PAPERS?

Tax documents should be kept as follows:

- Local taxes: Keep for 1 year after the tax year (extended to 3 years if there’s a tax reduction).

- Income taxes: Retain for 3 years after the tax year (4 years for withholding tax).

- Audiovisual contribution documents: Keep for 3 years after the tax year.

WHAT TO DO WITH COURT PAPERS?

Court documents have varying retention periods:

- Fines: Keep for 3 years (legal actions can no longer be initiated after 2 years).

- Notary or bailiff fee invoices: Keep for 5 years.

- Lawyer’s fee invoices: Retain for 2 years.

- Debt recognitions: Keep for 30 years (from the end of repayment).

WHAT TO DO WITH YOUR ACCOMMODATION PAPERS?

Here’s how long to keep accommodation-related documents:

- Chimney sweeping certificates, telephone, and internet bills: Retain for 1 year.

- Service provider contracts: Keep for the duration of the subscription.

- Lease agreements, rent receipts, etc.: Keep for 3 years.

- Water, gas, and electricity bills: Keep for 5 years.

- Co-ownership charges and meeting minutes: Retain for 10 years.

- Invoices for work: Keep for 10 years (same as for the ten-year guarantee).

WHAT TO DO WITH WORKING PAPERS?

For employment-related documents, retain the following:

- Pay stubs: Keep until you retire.

- Unemployment benefit certificates: Retain for 3 years (this is the period within which the employment center can contest an erroneous payment).

- Dismissal letters: Keep for 1 year.

- Balance sheet documents and employment certificates/contracts: Keep until retirement.

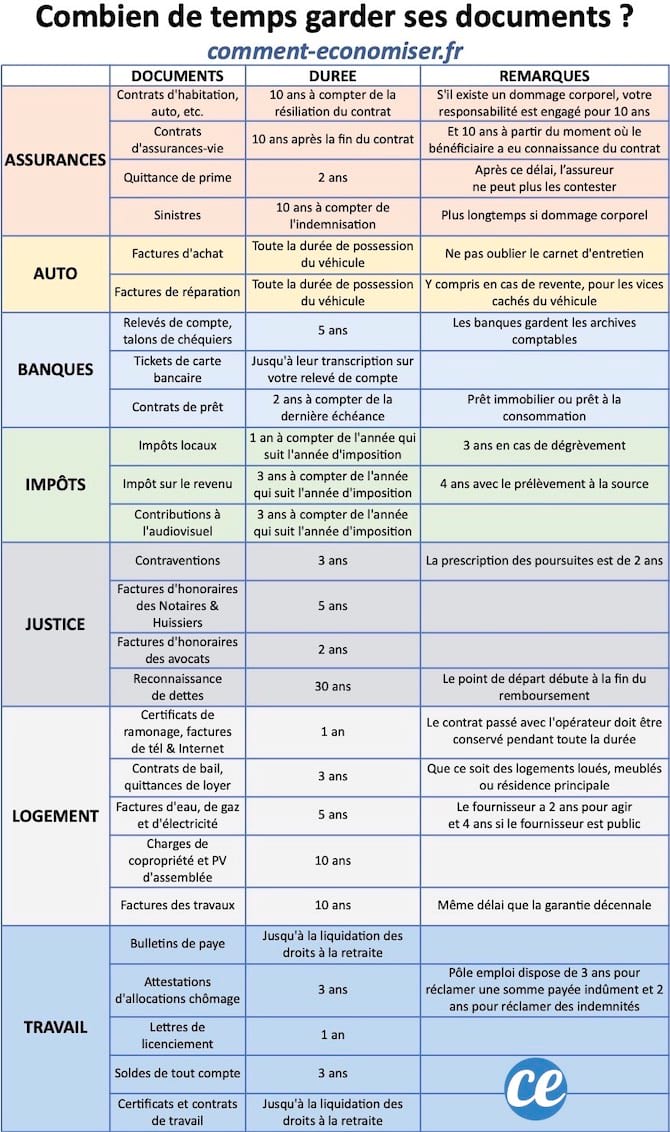

SUMMARY TABLE